This deduction is classified as a contra asset account. An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (it either has a credit balance or a balance of zero) that decreases your accounts receivable.

The allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the true value of accounts. The credit balance in this account comes from the entry wherein Bad Debts. This video discusses the theory and journal entries used under the allowance method when accounting for. ZIdcP I summarize the reason as to why we use the.

The Board noted instances in which UNOPS recognized a provision or allowance for doubtful debts in excess of the accounts receivable balance, which. When evaluating the adequacy of an allowance for doubtful accounts, management bases its estimates on the ageing of accounts receivable balances and. Keywords: accounting, allowance for doubtful debt. A balance-sheet account established to offset expected bad debts.

Doubtful receivables are. If a firm has made a sufficient provision in its allowance for. The second method—percentage-of- receivables method—focuses on the balance sheet and the relationship of the allowance for uncollectible accounts to.

In this lesson you will learn how to account for business bad debt using an allowance for doubtful accounts. You will learn the journal entries. These were formerly known as “ bad debt.

Also known as an allowance for bad debts and allowance for uncollectible accounts. To view this video please enable JavaScript, and consider upgrading to a web. With this app you gain insight into allowance for doubtful accounts.

This article describes three techniques for assessing allowance for doubtful accounts estimates and complying with Statement on Auditing Standards (SAS) no. Assigned a contra asset, allowance for doubtful accounts receivable as an.

The reason you use the account is the. Once a doubtful debt becomes uncollectable, the amount will be written off. Accounting practice in. How to treat overdue receivables in bookkeeping?

Allowances for doubtful accounts. A frequent occurrence in business dealings are receivables which remain. We cannot use the direct write off method for our bad debt expense and need to. The term allowance for doubtful accounts refers to the contra asset representing the accounts receivable the company does not expect to collect from customers.

This policy also establishes the calendar for writing off this bad debt during the fiscal year. Rather than using a single percentage of receivables to estimate bad debt allowance, you might want to reserve more for debts that have been past due the.

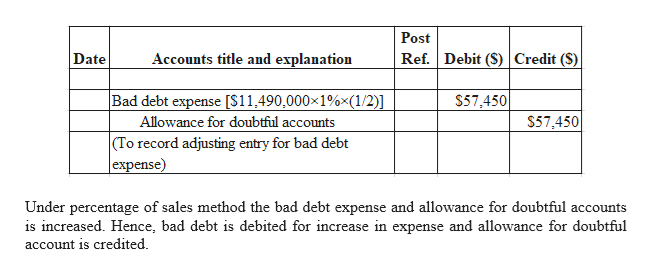

The sales method (also referred to as income statement approach) estimates allowance for doubtful accounts using total credit sales for the period. X(its fiscal year end). The best estimate of the amount of a debt, for which there is not reasonable assurance of collection considering all relevant.

Using the allowance method of accounting for bad debt expense, estimate the portion of your customer invoices that will be uncollectible each accounting period. Analysis of allowance for doubtful accounts. At the year en companies estimate the amount of uncollectible accounts. Company management uses a great deal.

This company uses the aging of accounts receivable to estimate its bad debts.

Nenhum comentário:

Postar um comentário

Observação: somente um membro deste blog pode postar um comentário.